Q1 Biopharma Recap

April 22, 2024 | Alec de la Durantaye |

Industry Articles

The first three months of the year have come and gone, it’s time to look back at what’s happened in the first quarter, and more importantly, unpack what this means going forward.

We’ll start by looking at cumulative funding numbers from the year thus far, along with FDA drug approvals from Q1. Then we’ll recount the number of companies that have announced future drug development activity, broken down by phase, including intended IND filings and more.

- Cumulative funding by region

- FDA Drug Approvals

- Upcoming Clinical Trials

- Upcoming IND Filings

- Upcoming NDA, BLA & MAA Filings

- Number of new biotech & pharma companies identified

Cumulative Funding

Drug discovery and development are heavily reliant on funding. The number of grants, VC funding rounds, and other investments made are great indicators of the general health of the industry, but also the direction we’re headed in.

At the end of 2023, we published our annual biopharma recap article which you can reference to compare Q1 2023 against Q1 2024. Let’s look at how the numbers add up so far this year.

Number of Companies that Received Funding in Each Region:

- North America = 602

- EMEA = 228

- APAC = 132

Last year was an average year for funding in biotech, and so expectations heading into the year were very much along the lines of “We’ll get more of the same”, thus far we’re getting exactly that. Our observation heading into this year was that preclinical and drug discovery service providers would have more opportunities this year thanks to more cash being invested within the emerging biopharma sector. While there were plenty of big investments made to new biotech & pharma companies, there were an additional 65 drug sponsors that were recipients of either SBIR or STTR grants. Overall this is a good sign for early-stage/small biotech companies looking to continue moving assets to clinical trials this year.

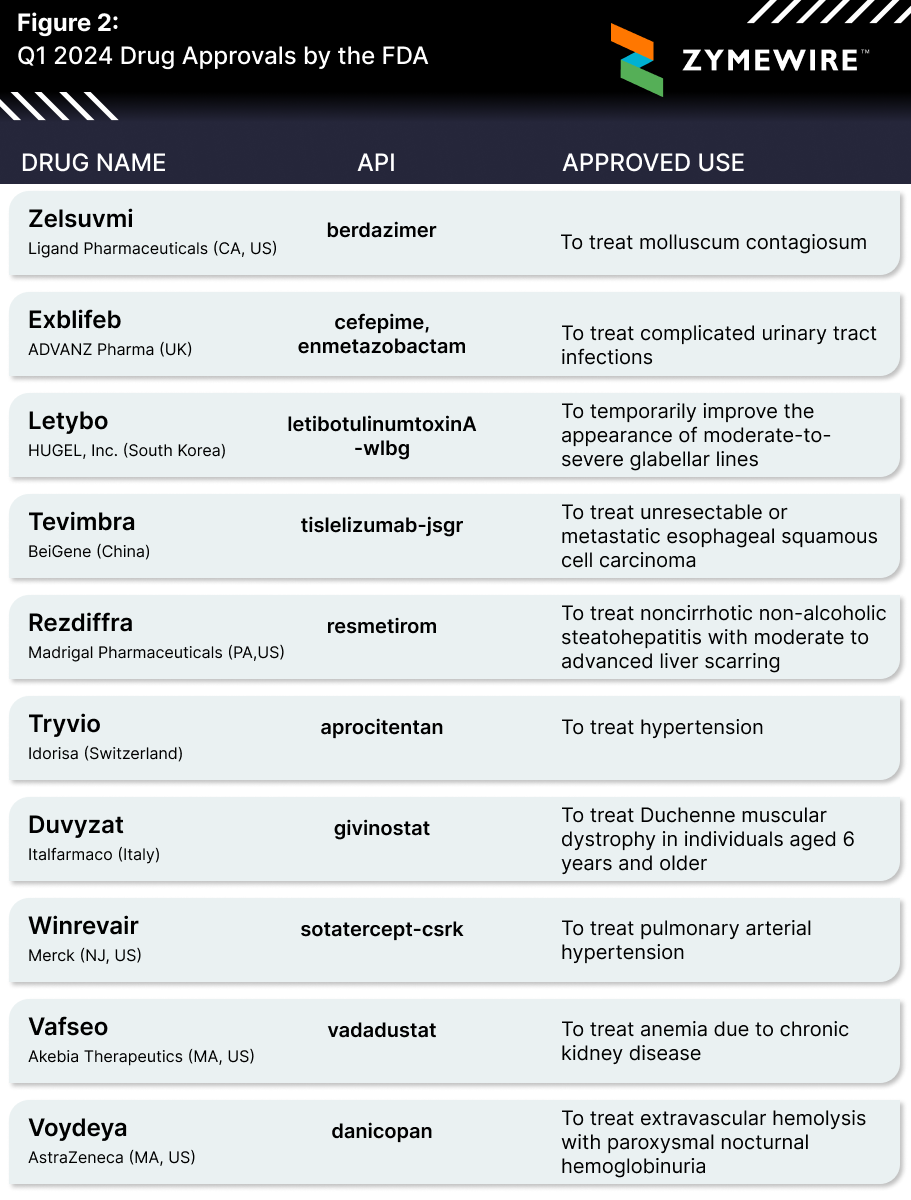

FDA Drug Approvals

The number of drugs approved by the FDA in a calendar year typically lies around the 50 mark. Last year we saw a big bounce back with 55 approved drugs, coming off a light 37 drugs back in 2022. While the number of drugs approved (year-to-date) doesn’t shed much light on how approvals will play out going forward, it’s always interesting to see what types of therapies are receiving the green light.

Amongst the 10 drugs approved thus far, Madrigal Pharma’s Rezdiffra (resmetirom) made a lot of noise, being the first approved drug for MASH. Our very own Elle Seigel discussed its significance upon approval, also diving into similar programs from other biotechs.

Upcoming Clinical Trials

At Zymewire, we’ve always been big advocates for getting ahead of clinical trials. Funding announcements, results disclosures, and executive changes often come with future drug development plans. These (future) plans can often be the entry point for service providers to begin scoping out partners to target, create new relationships, and eventually, new revenue.

Below, you’ll find three charts illustrating the number of companies with upcoming clinical trials for phases 1, 2, and 3. Each chart displays bars for North America, EMEA, and APAC.

NOTE: The organizations represented in these charts have mentioned upcoming clinical trials within the January 1 - March 31, 2024 timeframe, trial start dates fall outside this window (ie. April 1, 2024, or later).

Rapid Fire Stats

Lastly, we’ll leave you with some interesting statistics you likely won’t come across anywhere else, delivered in rapid-fire style.

- Zymewire identified 66 new biotech companies within the first quarter of 2024.

- A staggering 343 drug developers expressed intent to file one or more investigational new drug (IND) applications for existing assets, 73 of which will be filing INDs for the first time.

- A little further down the road, we have 123 drug developers who have expressed intent to file either a New Drug Application (NDA), a Biologics License Application, or a Marketing Authorisation Application (MAA).

- There were 1198 Organizations with activity in Q1 that have a highest clinical trial phase of 2.

- There were 281 Phase 1 trials marked as completed in Q1.

- There were 179 Phase 2 trials marked as completed in Q1.

- There were 105 Phase 3 trials marked as completed in Q1.

Companies Affiliated with Biologics with Upcoming Clinical Trials:

- Preclinical/Discovery = 240

- Phase 1 = 341

- Phase 2 = 393

- Phase 3 = 248

Companies Affiliated with Small Molecules with Upcoming Clinical Trials:

- Preclinical/Discovery = 164

- Phase 1 = 258

- Phase 2 = 305

- Phase 3 = 193

Note: Companies can be included in more than one of these lists.

With that, we're signing off! We hope you enjoyed this quarterly recap, please do let us know what you'd like to see included in our Q2 recap in a few months. Thanks for reading!

Zelsuvmi, berdazimer, Ligand pharmaceuticals, Exblifeb, cefepime, enmetazobactam,, ADVANZ Pharma, Letybo, letibotulinumtoxinA-wlbg, HUGEL, Tevimbra, tislelizumab-jsgr, Tevimbra, BeiGene, Rezdiffra, remetirom, Madrigal Pharmaceuticals, aprocitentan, Tryvio, Idorisa, givinostat, Duvyzat, Italfarmaco, Winrevair, sotatercept-csrk, Merck, Vafseo, vadadustat, Akebia Therapeutics, Voydeya, danicopan, AstraZeneca.

.png?width=500&name=Q3%202024%20Biopharma%20Recap%20(Zymewire).png)

Comments